FEBRUARY 2025

BFG Spotlight – Justin Gibson, BFA™

A young Justin Gibson sat beside his dad with the monthly edition of the Cabot Market Letter spread out between them. Each month when the letter arrived, father and son discussed the various stocks and investment recommendations inside the report.

“I was in fifth or sixth grade at the time, and he and I would look through and read it together. He also included me on some of his own investing and that got me really interested at a young age,” he recalled.

Several years later, his dad, Ron Gibson, took him to start his own account at Scottrade in St. Louis, and this sparked Justin’s passion and career in finance.

In January, Justin celebrated 15 years at Benson Financial Group as a financial advisor and part-owner. His journey to BFG was one paved with God’s intention, which included a lot of hard work.

Justin, a Hannibal native, attended Moberly Area Community College then transferred to Hannibal-LaGrange University where he earned a bachelor’s degree in business administration with an emphasis in finance. Living at home and paying for school on his own, he juggled college classes with working at County Market and Hannibal National Bank (HNB).

Ron and Lisa Gibson with their sons, Justin, and Jacob.

"Both were great jobs for a young person, and helped me build relationships in the community,” he said. “Working in the retail setting also taught me about customer service and how to treat people.”

Some of the connections made at his previous jobs withstood the test of time, including his wife, Brooke, who he worked with at County Market.

Justin also connected with Connie Benson—who alongside her husband, Pat, founded Benson Financial Group. He first met the Bensons through church, but since Connie was a regular in his lines at County Market and the bank, she came to know him professionally as well.

Still finishing his degree, Justin arranged a meeting with Pat through Connie about a possible internship with the company. While BFG—a young company at the time—was not looking for an intern, Pat and Connie had greater things in mind for Justin. Seeing his potential, they kept in touch with him.

It was around 2008—during a time now known as the Great Recession—and Justin worried if opportunities for young finance graduates would exist. However, he had several interviews and offers when he graduated.

One in particular stood out.

Pat met with Justin a second time and offered an opportunity to join BFG—as both a financial advisor and part-owner.

He noticed from the start that the office reflected a unique atmosphere of fun, humor and Christian values.

“Very early on, this culture was here, and I just couldn’t pass that up,” Justin recalled. “I talked to my parents and made the decision to join Benson Financial Group.”

His first day on the job was Jan. 4, 2010, and it was a monumental day for Benson Financial Group. They went from Pat working solo in the office to include Connie as an administrative assistant, along with Justin and Steve Hill as financial advisors—each coming on as owners.

Connie and Steve both retired last year but they remain valued members of the BFG team. Even with exponential team growth over the years, this special culture continues at Benson Financial Group.

For Justin, and the rest of the BFG team, financial advising is more than crunching numbers or maximizing investment returns—it’s about helping people discover their ‘whys.’ Justin wants to truly know his clients and for them to know him.

“We combine serious planning with lightheartedness, humor and fun—because we want clients to get to know us as well. We want to come alongside people and walk their financial journey with them—help them find financial freedom and to know things are going to be okay,” Justin said.

For Justin, knowing that God uses him to help guide clients with their resources, makes him feel good about the work they are doing at BFG.

“There is a lot of fear around money and retirement. Am I saving enough? Am I spending too much? We want to help make sure those questions are answered, and that you are living the life God wants you to live, as a good steward with your finances,” he said. “That doesn’t include being a miser with your money. We want people to find the freedom to donate to charities, their churches, and everything else near and dear to their hearts. Maybe that’s their kids and grandkids.”

Making a personal connection with clients comes from another trait Justin was raised with.

“Helping people is something I grew up with. My parents instilled in us to have a servant’s heart,” he said. “I remember shoveling neighbors’ driveways and mowing yards—things we did just for fun and a nice gesture. They did start paying us, and we appreciated that too.”

This is a trait Justin, and his wife Brooke—a cancer nurse navigator at Blessing Cancer Center Hannibal—are ins tilling in their own three girls, McKenzie, Madison, and Mila. The family attends Madison Park Christian Church in Quincy.

Giving back to the community is at the heart of the Gibson family. It’s not uncommon to find Justin working at local charity events. He recently made and served homemade ice cream at the United Way’s Charcuterie for Charity event, helping raise money for the Child Advocacy Center—and helping the organization win the Best Tasting Award.

Justin actively serves on local boards and service organizations, including the Hannibal Chamber of Commerce, Hannibal Regional Hospital Foundation Board, Child Advocacy Center of Northeast MO, Mark Twain Home Foundation Board, and Hannibal Career and Technical Center Advisory Board.

He also serves with Gideons International Ministry and Early Bird Kiwanis.

“This community has not just been good to BFG, but also to my wife and me,” Justin said. “It just feels really good to be able to give back to a community that has always loved on us so well.”

Justin is also on the advisory board for Faithfully Nurturing Children (FNC) Academy, a school in Kampala Uganda, which BFG has been involved with since its founding. He and Brooke recently traveled to Kampala with a group from BFG to attend the school’s first graduation, which included Thomas—a student they sponsor.

In light of living out his faith, Justin reflected on a favorite Bible verse:

but in your hearts honor Christ the Lord as holy, always being prepared to make a defense to anyone who asks you for a reason for the hope that is in you; yet do it with gentleness and respect, having a good conscience, so that, when you are slandered, those who revile your good behavior in Christ may be put to shame. For it is better to suffer for doing good, if that should be God’s will, than for doing evil. —1 Peter 3:15-17

“As Christians, we should live our lives in such a way that people notice something different. They see there’s something we are living for and want to know about it. They want to know where the hope we have comes from,” he said. “It’s a great reminder to always be prepared to share our faith in Jesus, but to do so in a respectful and gentle manner.”

New Employees

Heidi Snyder

coordinator

Becky Speckhart

administrative assistant

Mark Bond

paraplanner

Megan Duncan

administrative assistant

Benson Financial Group is pleased to welcome its new employees: Heidi Snyder, coordinator; Becky Speckhart, administrative assistant; Mark Bond, paraplanner; and Megan Duncan, administrative assistant.

A Review of the 2024 Market

By Jeriod Turner, BFA™, CFP®, BFG Financial Advisor

The economy ended last year strong, growing at 3.1% in the third quarter, which was better than expected. Unemployment is still low at 4.2%, but inflation remains high at 3.3%, above the Federal Reserve’s target of 2%.

The Stock Market Performance

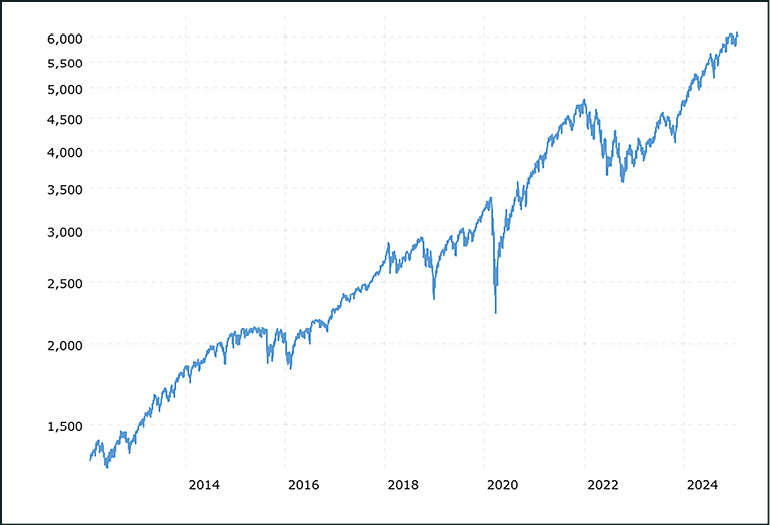

The stock market had a great year in 2024, with the S&P 500 (a group of the 500 largest companies in the U.S.) gaining more than 23%, with a total return of 25% (including dividends). The S&P 100, a smaller group of the largest and most established companies within the S&P 500, also saw strong growth, largely driven by technology and communications stocks.

There were 57 record highs in 2024—the fifth-highest number since 1957—with no major market declines. A major contributor to this success was a group of seven large tech companies, known as the “Magnificent Seven,” which included companies like Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, NVIDIA, and Tesla. They helped push up stock values, especially with the growth of artificial intelligence (AI).

Large vs. Small Companies

Larger companies, worth $10 billion or more, performed better than smaller ones. However, small companies still saw an increase of 14.4%, which is good news for those invested in them.

The Impact of the Election

Despite not seeing a “Santa Claus Rally” in December (a traditional year-end market boost from late December to early January), the market still saw a 3% increase after the election.

The markets reacted positively to federal changes, including tax cuts and less regulation, which are viewed as beneficial for economic growth. The Tax Cuts and Jobs Act from 2017, which brought significant changes to the U.S. tax code, including lowering corporate tax rates and modifying individual tax brackets, was set to end in 2025, but is now expected to be extended. This provided a boost for the market.

Bond markets saw a major fourth quarter selloff sparked by the election and the potential for stronger economic growth, inflationary policies, and more deficient spending in coming years.

Yields on the 10-year treasury note rose from 3.78% at the beginning of the quarter to 4.54% at the end of the year. The biggest losses came from long-term treasury bonds, which fell more than 8%.

On the other hand, Bitcoin made headlines post-election by soaring past $100,000 in value, drawing attention from investors.

Federal Reserve Actions

In December, the Federal Reserve reduced interest rates for the third time since September—totaling 1.0% in cuts in 2024 and bringing rates to a range of 4.25% to 4.5%. These cuts are expected to continue at a slower pace, with two cuts predicted in 2025.

Looking Ahead

Looking to 2025, the economy is still strong, but challenges remain. Inflation is still high, which may affect interest rates and economic growth.

On the global front, trade issues and potential tariffs (taxes on imports and exports) could create uncertainties. While tariffs have supporters who believe they help protect U.S. businesses, others worry that they may lead to higher prices for consumers and slow global trade.

Despite these concerns, technology continues to grow and brings new opportunities. However, investors will need to stay cautious as they navigate both the risks and opportunities that lie ahead in the year to come.

These views are those of the author, not of the broker-dealer or its affiliates. This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. All investments involve risk, including loss of principal. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. Cryptocurrency and cryptocurrency-related products can be volatile, are highly speculative and involve significant risks including: liquidity, pricing, regulatory, cybersecurity risk, and loss of principal.

Upcoming Holidays & Closings

Our office will close in observance of Presidents’ Day on Monday, February 17. Benson Financial Group, along with the markets, will reopen on Tuesday, February 18, at 8:30 a.m.

As we remember the leaders of our past, may we also take time to pray for wisdom and guidance for the present and future leaders of our nation.

“Leadership is not only having a vision, but also having the courage, the discipline, and the resources to get you there.” George Washington